Understanding the Risk-Confidence Gap

Close the Risk-Confidence Gap with Advance PAI Solutions

While businesses and governments seek to maximize their use of data for risk assessment and mitigation, they are confronted with an inability to effectively process growing volumes of data. Since humans simply can’t digest and analyze all the available data in every language, organizations look to AI for security teams and advanced risk intelligence solutions to perform the heavy lifting. But these tools often fall short as well — especially when it comes to analyzing unstructured, multilingual text that comes from all over the internet.

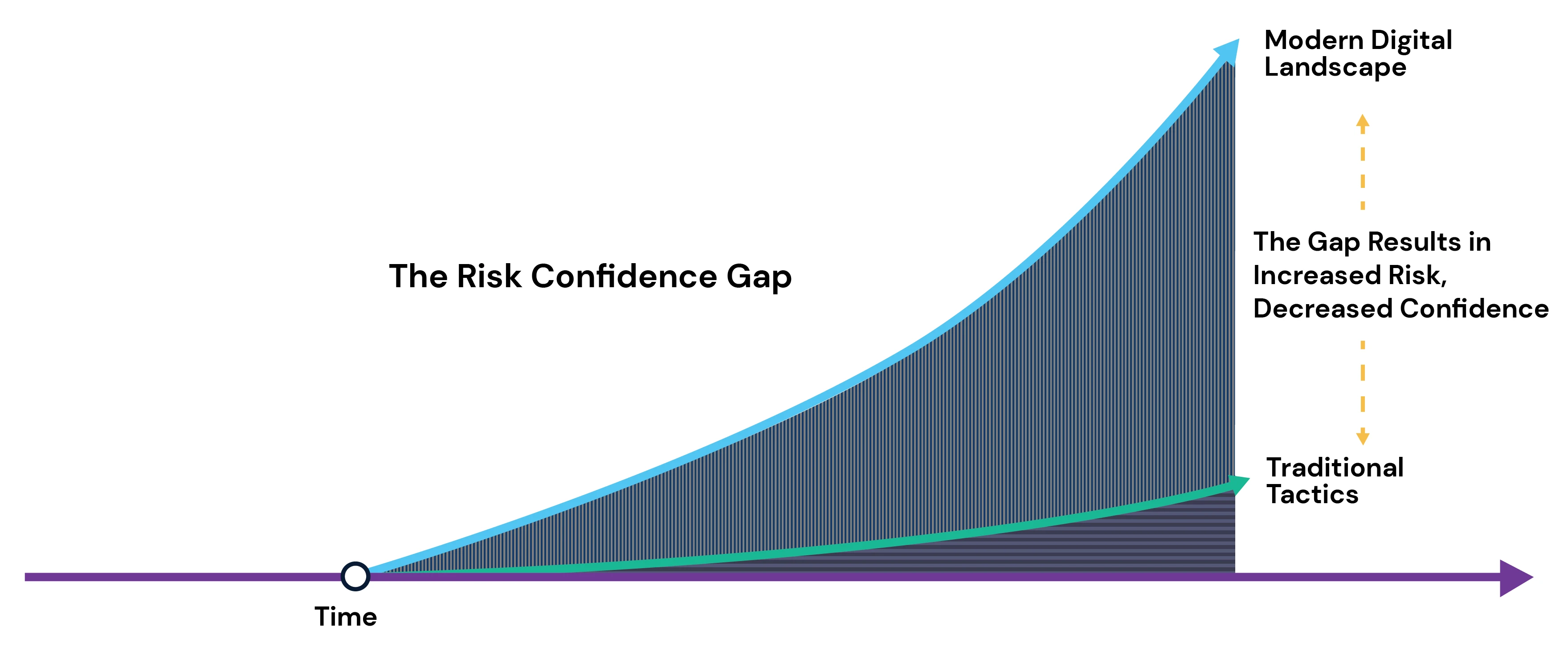

As analysts try to derive insights from data to inform business- and mission-critical decisions, they are overwhelmed with doubt. Are they able to analyze risk management data quickly and accurately enough for leaders to make what could be life or death decisions? We call this doubt the Risk-Confidence Gap, where the Gap is the widening chasm between the escalating volume and variety of data that must be examined to obtain insight and identify threats, and the resources available to analyze it.

Where does the Risk-Confidence Gap occur?

With today’s avalanche of data, the Risk-Confidence Gap is everywhere — in business, government, healthcare, finance, supply chain — anywhere that massive quantities of multilingual data require taming and analysis. But it’s especially prevalent in organizations that must harvest and analyze publicly and commercially available information (PAI/CAI).

Financial institutions

Financial institutions (FIs) must adhere to a wide range of anti-money laundering (AML) regulations designed to prevent criminal or sanctioned entities from using financial systems. FIs must make decisions quickly around whether to onboard a new customer and must maintain constant vigilance when monitoring existing customers for adverse media mentions, appearance on sanctions lists, or other activities that could indicate money laundering. FIs frequently rely on open source information (OSINT) like PAI and CAI for their compliance decisions, but the volume and extent of this data mean that FIs experience the Risk-Confidence Gap with regularity.

Learn the basics

Blog

What is the Risk-Confidence Gap?

As anyone who works in intelligence knows, there’s a widening chasm between the escalating volume and variety of data that must be examined to obtain insight an...

eBook

AI Helps Financial Institutions Comply with Emerging Regulations

Current perspectives on regulations and the value that AI delivers to the financial sector for AML/KYC compliance.

Webinar

AI Solutions to Close the Risk-Confidence Gap in Financial and Government Organizations

May 22, 2024 at 1 p.m. ET / 10 a.m. PT

Babel Street helps close the Risk-Confidence Gap

The Babel Street Ecosystem — consisting of Analytics, Data, and Insights products — delivers advanced AI and data solutions to ensure robust protection against evolving threats, mitigate risk, and enhance decision-making confidence.