Babel Street Financial Services Compliance

Financial institutions — and the FinTechs that serve them — are required to perform increasingly stringent customer due diligence and risk mitigation to prevent financial crime. Babel Street offers AI-driven solutions for name screening, adverse media monitoring, and know your customer (KYC)/know your vendor (KYV) due diligence.

Simplify financial compliance by minimizing risk

Fewer False Positives

Minimize false alarms and increase productivity by adding automation to screening and remediation processes

Multilingual Watchlist Screening

Match names across different scripts and languages, accounting for numerous linguistic and contextual factors — without compromising performance

Customized and Understandable Results

Tailor how you match data fields to conform with policies and requirements, and understand match decisions with explainable AI

Rapid Ownership Tracing

Process news sources, corporate filings, and public records for ultimate beneficial ownership (UBO) investigations using AI-driven entity extraction from multilingual text

Unmatched Access to Data

Put publicly available information to work for adverse media screening, identification of politically exposed persons, and ongoing KYC due diligence

Automated Compliance Processes

Conduct more thorough anti-money laundering and sanctions screening during onboarding and for ongoing compliance

Explore financial compliance use cases

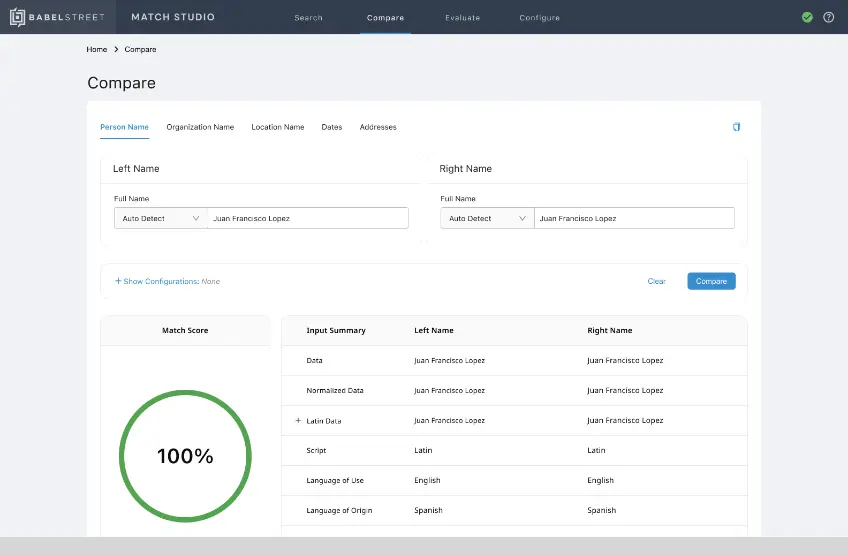

Match names to watchlists

Rapidly conduct watchlist and sanctions screening by leveraging AI-driven technology and expansive, multilingual data sources. This scalable approach ensures comprehensive monitoring and compliance, enabling financial institutions to efficiently identify and mitigate potential risks across vast datasets.

UBO, adverse media, and PEP screening

Babel Street helps make connections between people and organizations to understand the complex relationships that underlie money laundering operations. This ability coupled with our expansive data sources for adverse media and politically exposed persons (PEP) screening puts powerful tools in the hands of financial institutions to obtain a complete picture of potential customers.

See it in action

Use Case

Using Babel Street to Streamline KYC/KYV Processes

How Babel Street applies to AML, KYC, and KYV compliance

Case Study

DOKS: Fintech Reduces False Positives by 75% for KYC/AML

How DOKS used Babel Street Match to reduce false positives in financial screening

Case Study

Nomura Research Institute: Babel Street Supports Regional Financial Institutions with Increased AML/CFT Effectiveness

How Nomura Research Institute incorporated Match into its financial compliance solution in Japan

Case Study

The AI That Powers LSEG World-Check® One

How LSEG uses Babel Street Match to power its World-Check One solution

Explore solution components

AI-powered identity matching that accurately links names, addresses, and dates across languages — reducing false positives and enabling fast, explainable decisions in high-risk environments

Learn more about financial services compliance

eBook

AI Helps Financial Institutions Comply with Emerging Regulations

Current perspectives on regulations and the value that AI delivers to the financial sector for AML/KYC compliance.

Data Sheet

AI Solutions for Transforming Financial Compliance

How the AI-powered name matching capabilities of Babel Street help financial institutions comply with AML/KYC regulations.

eBook

Matching Software Surmounts Four Major AML/KYC Challenges

Babel Street helps FIs improve AML/KYC by more quickly analyzing, matching, and scoring the names of individuals and corporations.